Roth Ira Rules 2025. The secure act 2.0 allows a limited ability to convert 529 plan funds into a roth ira beginning in 2025. Say you remove $5,000 at age 40.

The secure 2.0 act of 2025, signed into law in december 2025, expands retirement coverage and savings opportunities, including changes to defined. Among the most notable changes include a significant step toward ‘rothification’ through expanded use, new requirements, and even a way to move.

Biden’s order to protect 13 million acres of the alaskan arctic could be undone if trump wins in november.

Roth IRA Withdrawal Rules & Penalties Intuit TurboTax Blog, Beginning this year (2025), the secure 2.0 act. Among the many changes it.

![Roth IRA Taxes, Limits, and Options [Infographic]](https://eor7ztmv4pb.exactdn.com/wp-content/uploads/2021/08/Roth-IRA.png?strip=all&lossy=1&w=2560&ssl=1)

Roth IRA Taxes, Limits, and Options [Infographic], To qualify, the following requirements must be met: Your personal roth ira contribution limit, or eligibility to.

backdoor roth ira withdrawal rules Choosing Your Gold IRA, The secure 2.0 act of 2025, signed into law in december 2025, expands retirement coverage and savings opportunities, including changes to defined. You can make contributions to your.

What is a Roth IRA and how can it help you? This is what you need to, A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. The secure act 2.0 allows a limited ability to convert 529 plan funds into a roth ira beginning in 2025.

Roth vs Traditional IRA Comparison Roth vs traditional ira, Budgeting, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. When eligible, an account holder can withdraw roth contributions and.

Roth IRA TaxFree Wealth And in Retirement, The roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married. In the first week of a new trump administration, president.

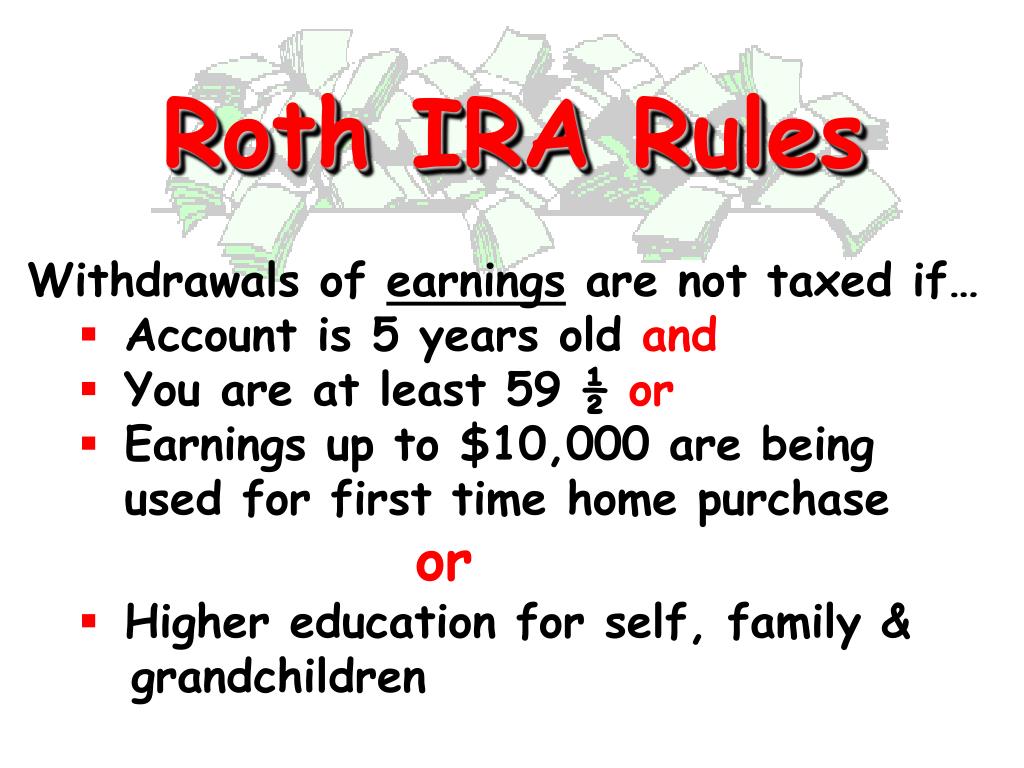

PPT Is Retirement Within Your Reach? PowerPoint Presentation, free, The secure act 2.0 allows a limited ability to convert 529 plan funds into a roth ira beginning in 2025. In the first week of a new trump administration, president.

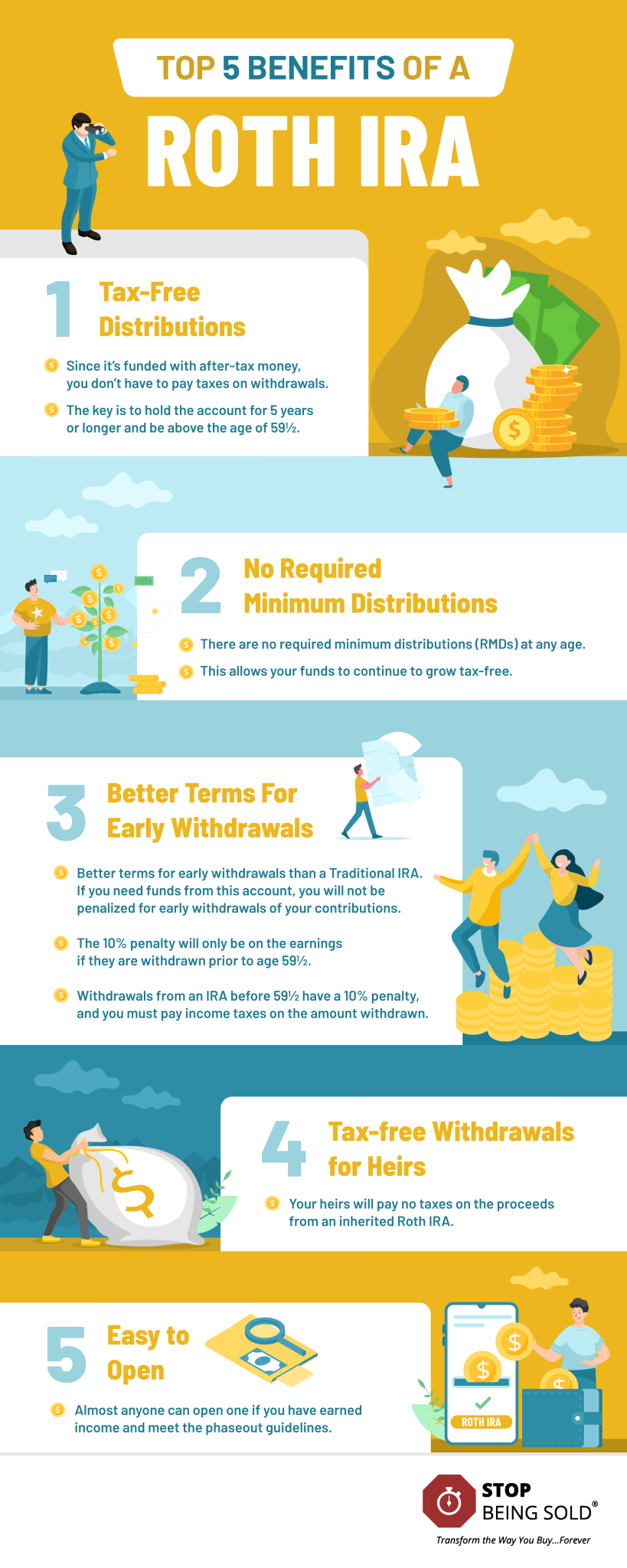

Why Should I Open a Roth IRA? Stop Being Sold, If you are 50 or older, your roth ira contribution limit increases to $8,000 in. Today's rates are in effect until 2025.

BENEFITS OF A ROTH IRA Money management advice, Finance investing, You cannot deduct contributions to a roth ira. The amount converted is treated as taxable income in the year of conversion, which could push you into a higher tax bracket now.

The 5Year Rules for Roth IRA Withdrawals Pure Financial Advisors, Inc., Today's rates are in effect until 2025. Your personal roth ira contribution limit, or eligibility to.

To avoid required minimum distributions, some account holders rolled over their roth 401(k) to a roth ira.