Ctc Income Limits 2025. The ctc won’t change the amount people receive in other federal benefits, like unemployment insurance or medicaid. Additionally, there are income thresholds that may phase out the credit at higher income levels.

A bill to expand the child tax credit still hasn’t been passed, and those claiming the child tax credit may. The credit would be adjusted for inflation starting in 2025, which is expected to bump up the maximum credit to $2,100 per child in 2025, up from the current $2,000,.

Proposed changes to the ctc are part of a tax bill still before congress that could expand eligibility and the amount of the ctc.

Child Tax Credit 2025 Limits Amount Lizzy Querida, 2025 income limits for projects placed in service on or before 12/31/2008. How many kids would benefit from.

Roth Limits 2025 Theo Ursala, The american rescue plan increased the child tax credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for. The bill addresses issues limiting the credit for some poor families, such as providing no credit for a family’s first $2,500 of income.

Chp+ Limits 2025 Avie Melina, For the 2025 tax year (returns you'll file in 2025), the refundable portion of the credit increases to $1,700. The full credit amount would be available to single filers earning.

Hsa Limits 2025 Rycca Clemence, See section below for a potential 2025 expansion to ctc payments. If passed, the bill would incrementally raise the amount of the credit available.

Maximize Your Paycheck Understanding FICA Tax in 2025, These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by tax year (6 april to 5 april). In short, the ctc begins phasing out for families with income above $200,000 (single filers) or $400,000 (joint filers).

Oregon Health Plan Limits 2025 Kit Sallyanne, 2025 income limits for projects placed in service on or before 12/31/2008. If passed, the bill would incrementally raise the amount of the credit available.

2025 HSA & HDHP Limits, Last week, the ways and means committee passed a bipartisan bill that would expand the child tax credit (ctc), temporarily restore three business tax. The child tax credit (ctc) serves as a crucial.

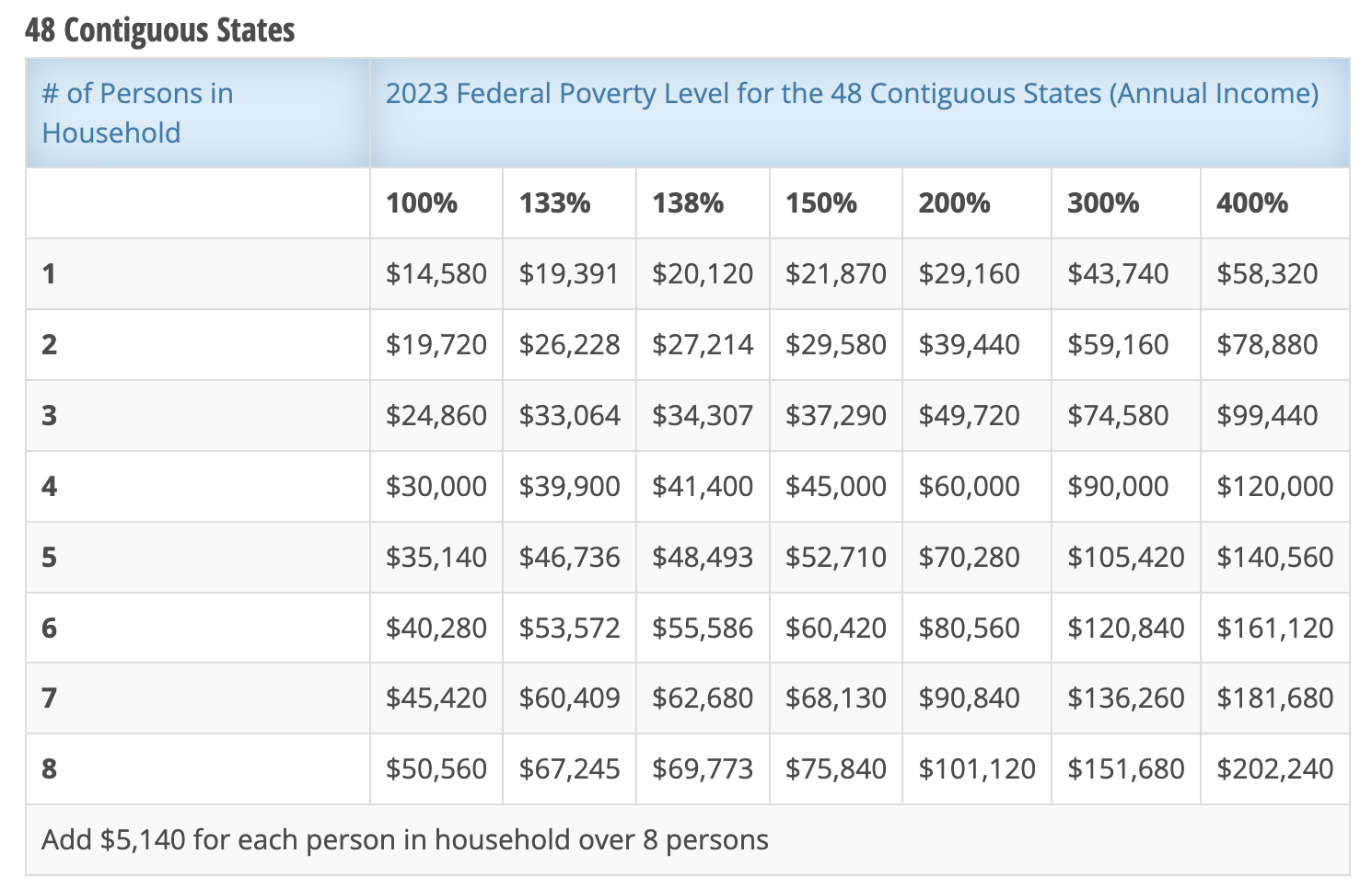

USCIS Federal Poverty Guidelines for 2025 Immigration Updated, The ctc won’t change the amount people receive in other federal benefits, like unemployment insurance or medicaid. The american rescue plan increased the child tax credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for.

Ss Earning Limit 2025 Beryle Leonore, The credit would be adjusted for inflation starting in 2025, which is expected to bump up the maximum credit to $2,100 per child in 2025, up from the current $2,000,. If passed, the bill would incrementally raise the amount of the credit available.

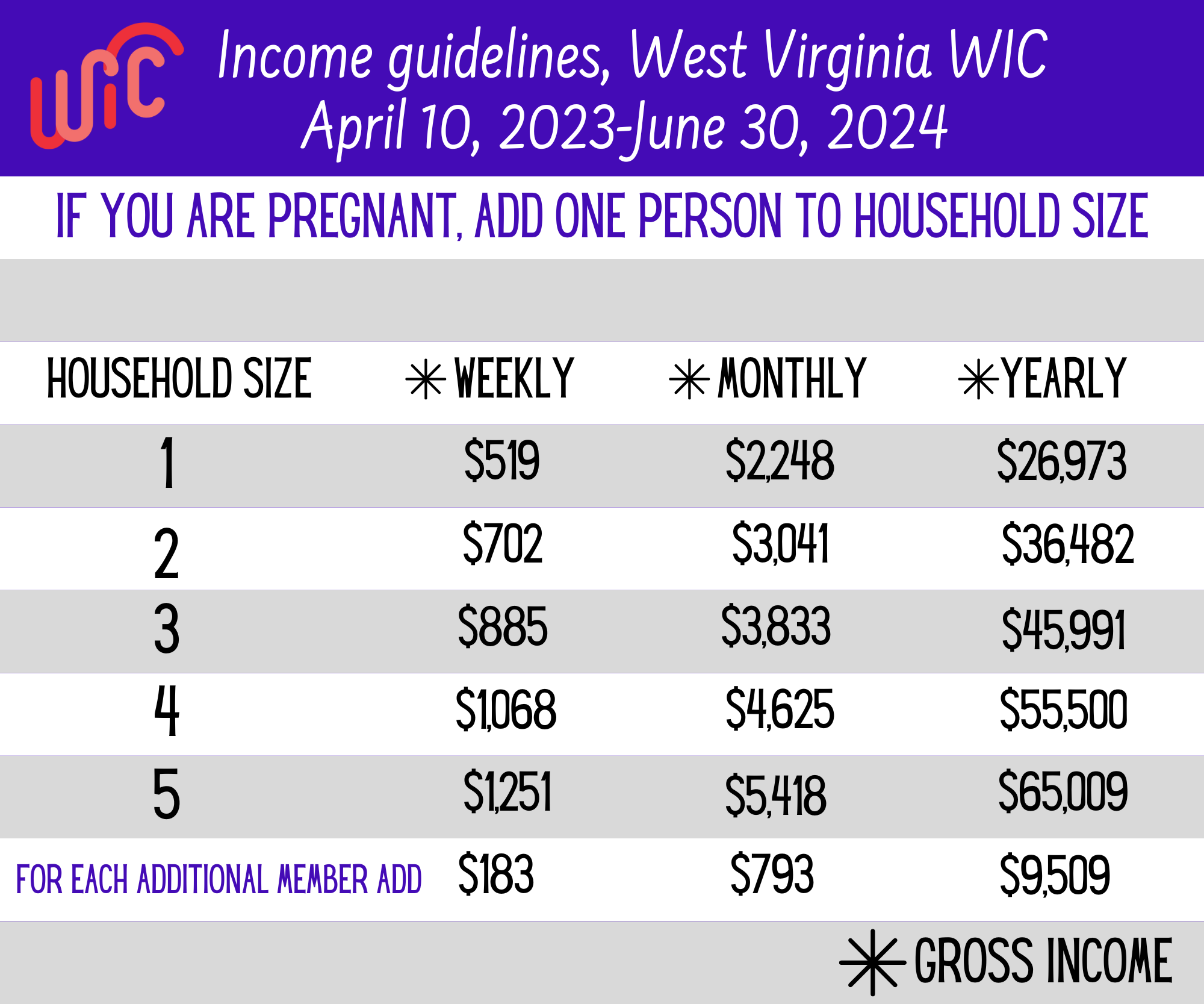

WIC Eligibility Guidelines Monongalia County Health Department, The credit would be adjusted for inflation starting in 2025, which is expected to bump up the maximum credit to $2,100 per child in 2025, up from the current $2,000,. President joe biden’s budget proposal for the 2025 fiscal year calls for fully restoring the child tax credit (ctc) enacted in the american rescue plan.

The maximum refundable amount per child would increase to $1,800 for the 2025 tax year, $1,900 for the 2025 tax year, and $2,000 for the 2025 tax year.